Calculate payroll taxes 2023

In fact if you know the latest inflation numbers it is possible to calculate the increase even before the IRS announces it in October or November. Useful for filing a no-payroll report or tax and wages for a small number of employees.

View All Hr Employment Solutions Blogs Workforce Wise Blog

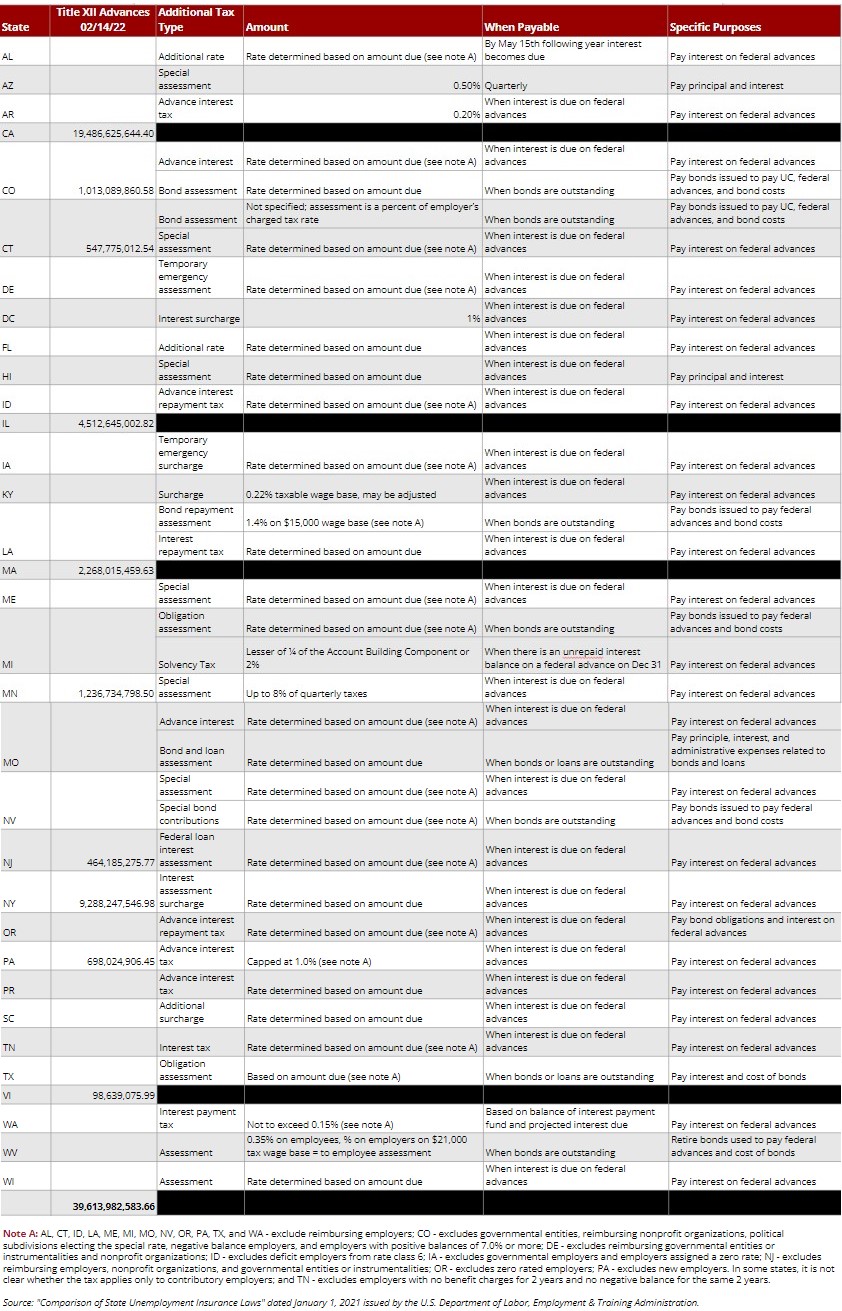

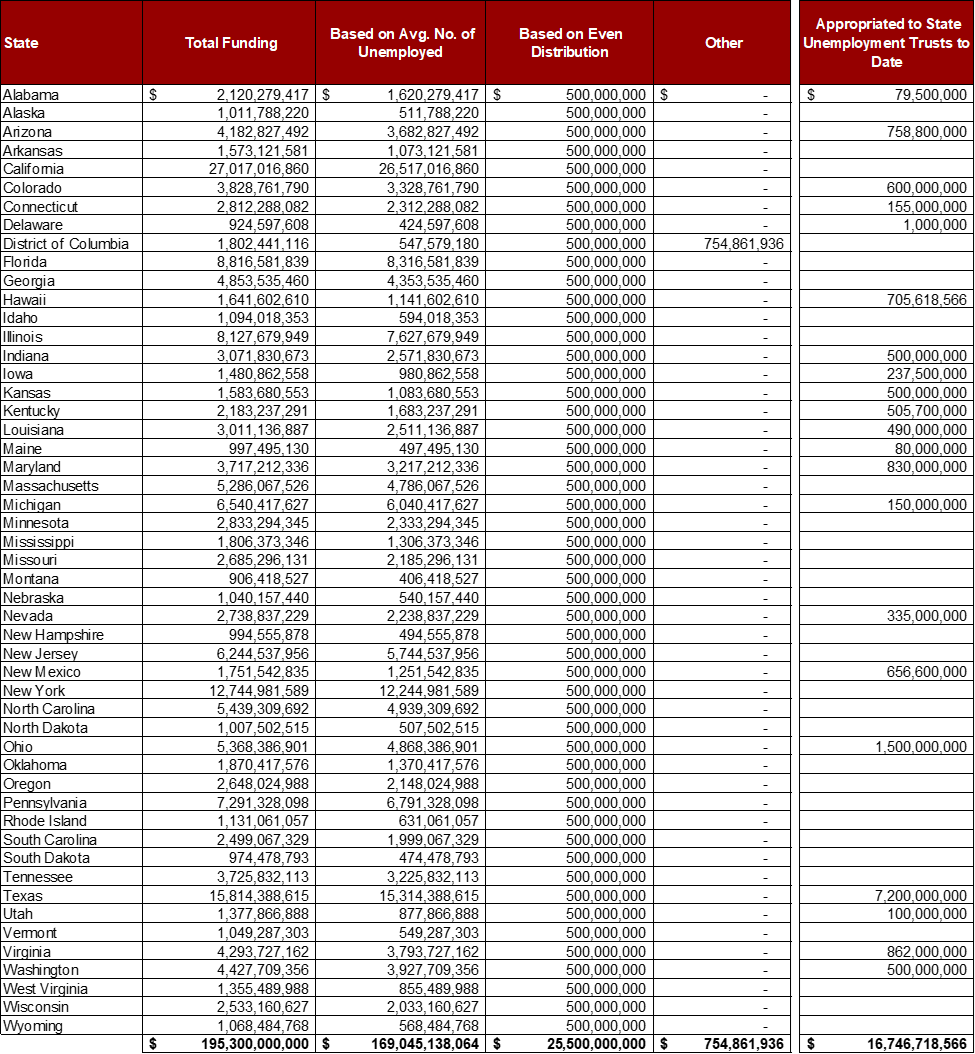

Calculate your unemployment taxes.

. Paying taxes as a household employer requires you to fill out and file Schedule H along with your federal income tax return and pay the tax amount due by April 18 2023. Proposed Active Duty pay raise for 2023 Proposed Reserve pay raise for 2023. ProPremier Plus System Requirements.

Inflation has exploded in the first half of 2022 all the way up to 91 in July so the 2023 contribution limits for many of these accounts will be increased. The White House and Congress have proposed a 46 pay raise for the military in 2023 the largest in nearly two decades. 2023 whichever comes first.

But if you are self-employed or make money on your investments or rental property you may need to make estimated tax payments every quarter rather than wait until you file. Purely Public Charitable Organizations shall calculate the tax that would otherwise be attributable to the municipality and file a return but shall only pay the tax on the portion of its payroll attributable to business activity for which a tax may be imposed pursuant to Section 511 of the Internal Revenue Code. Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year.

The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to assisting businesses through COVID. The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to assisting businesses through COVID. 4th Quarter of 2022 October November December.

TOTAL VALUE IN IDR Total Value in USD Total CIF x IDR exchange rate CIF Freight on Board Insurance Freight Cost x exchange rate. Do we know when the 20222023 mandatory annual salary increases will need to be applied please. It had originally closed applications on August 8 2020 but.

The closer you get to October the more accurate your projection can be. Wage tax wage withholding tax. Paycheck Protection Program PPP The Paycheck Protection Program offers loans to small businesses to keep employees on payroll and cover certain other expenses during the coronavirus pandemic.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Ohio local counties cities and special taxation districts. The payroll tax rate reverted to 545 on 1 July 2022. Other payroll deductions that may come into play.

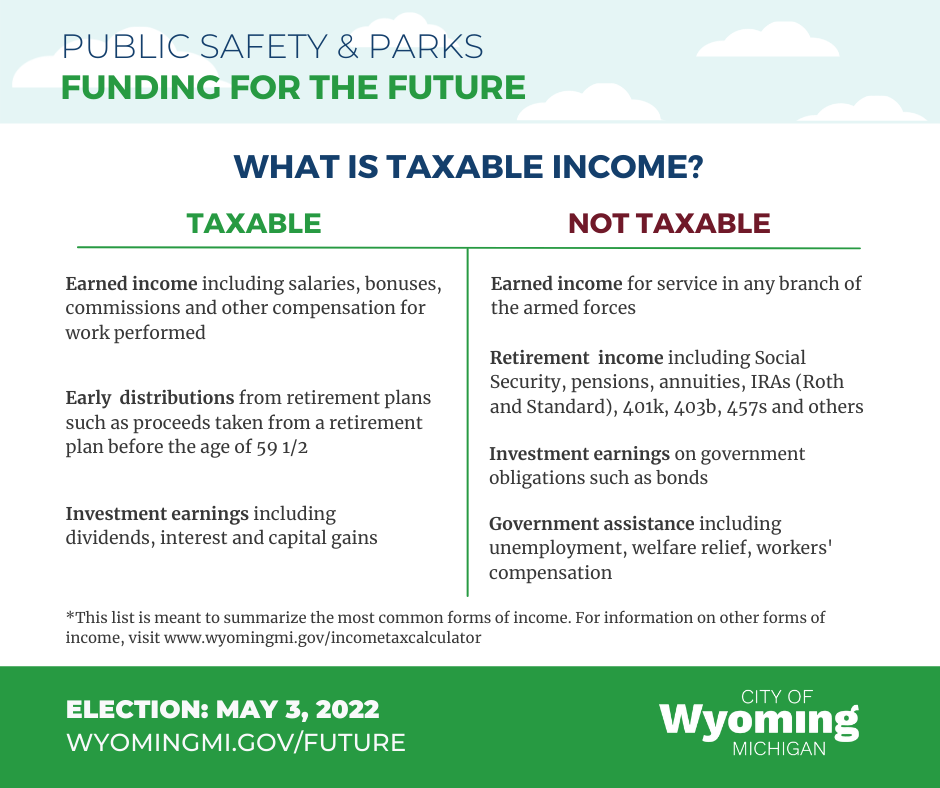

If you are an employee your employer withholds income taxes from each paycheck based on a completed W-4 Form. To calculate the total import tax you will first need to convert the total value of the goods to Indonesian Rupiah using the following formula. Determine Taxable Wages and Calculate Taxes Due.

Depending on company personnel policies employees may be able to choose benefits that actually result in tax savings. Should I expectask for the holiday payment 13th salary instalment be made in my first month of. As a small business owner there are likely parts of your work that you love and certain obligations youd rather avoid.

Federal and state payroll taxes are calculated for you. Use Schedule C of Form 1040 to calculate your net self-employment income. The following timetable will help you keep track of the important tax deadlines for submitting forms for the 2022 tax year.

You must pay these payroll taxes to the tax authorities. From 1st June 2021 to 30th May 2023. Automatically fills in federal and state payroll tax forms.

2022 unemployment tax rate calculator xls 2022 unemployment tax rate table. Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year. Refer to our payroll tax calendar to find due dates for employment tax returns wage reports and payroll tax deposits.

Payroll Preparation Tax. Learn about employment payroll and immigration for Belgium to help your company with local legislation. The expenses you pay with an EIDL advance are also fully tax deductible for federal taxes.

Usually thats enough to take care of your income tax obligations. 075 for 2023 085 for 2024 and 090 for 2025. Easily File Pay Taxes.

1 January 2023. To review if you work a full-time job that has payroll taxes deducted but then you earn 1000 through freelance work you have to pay self-employment tax on the net earnings from that 1000 unless the net is under 400. Calculate the correct contributions and taxes file a tax return and pay what you owe by the due date.

Learn about employment payroll and immigration for Portugal to help your company with local legislation. Windows 81 or Windows 10 updateversion supported by Microsoft. In all other years the flat social tax is capped at 122.

Fiscal Year 2023 beginning July 1 2022 is not a leap year. The payroll tax rate reverted to 545 on 1 July 2022. Payroll tax consists of.

For this you may want to use payroll software or hire a payroll office accountant or financial advisor. Yet love them or hate them employment taxes and payroll taxes arent something you can afford to ignore. Economists have focused on some of the problems.

The premium payee is entitled to the credit regardless of whether it uses a third-party payer such as a reporting agent payroll service provider professional employer organization PEO certified professional employer organization CPEO or 3504 agent to report and pay its federal employment taxes. Employees who wish more information on state and local taxes withheld should consult a tax professional or their companys payroll department. The Inflation Reduction Act attempts to raise hundreds of billions of dollars from corporations without raising the corporate tax rate through a 15 percent book minimum tax a new alternative minimum tax applied to the financial statement income ie book income that companies report to their investors.

2023 Delinquent if not filed by January 31 2023. Enter your bi-weekly gross to calculate your annual salary. The Citys payroll system is based on the fiscal year covering the period July 1 through June 30.

Click to e-file and pay your taxes. Please fill out the form to receive a free copy of our Belgium payroll taxes and benefits guide. For very small businesses at least it shouldnt be too complicated to calculate.

Please fill out the form to receive a free copy of our Portugal payroll taxes and benefits guide. The current calculator is not set for a leap year. How to calculate the total cost of import in Indonesia.

What Is The Bonus Tax Rate For 2022 Hourly Inc

View All Hr Employment Solutions Blogs Workforce Wise Blog

Salary Tax Calculator 2022 23 Pakistan Income Tax Slabs 2022 23

Corporation Tax Rate Increase In 2023 From 19 To 25

Estimated Income Tax Payments For 2022 And 2023 Pay Online

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Revised Salary Income Tax Rates 2022 23 Budget Proposals

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

2022 Federal State Payroll Tax Rates For Employers

Income Tax Tables In The Philippines 2022 Pinoy Money Talk

2022 Federal State Payroll Tax Rates For Employers

Income Tax Calculator

Biden Budget Biden Tax Increases Details Analysis

Salary Tax Calculator 2022 23 Pakistan Income Tax Slabs 2022 23

Calculate 2022 23 Uk Income Tax Using Vlookup In Excel Youtube

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Kwv9ygm 1s0jmm